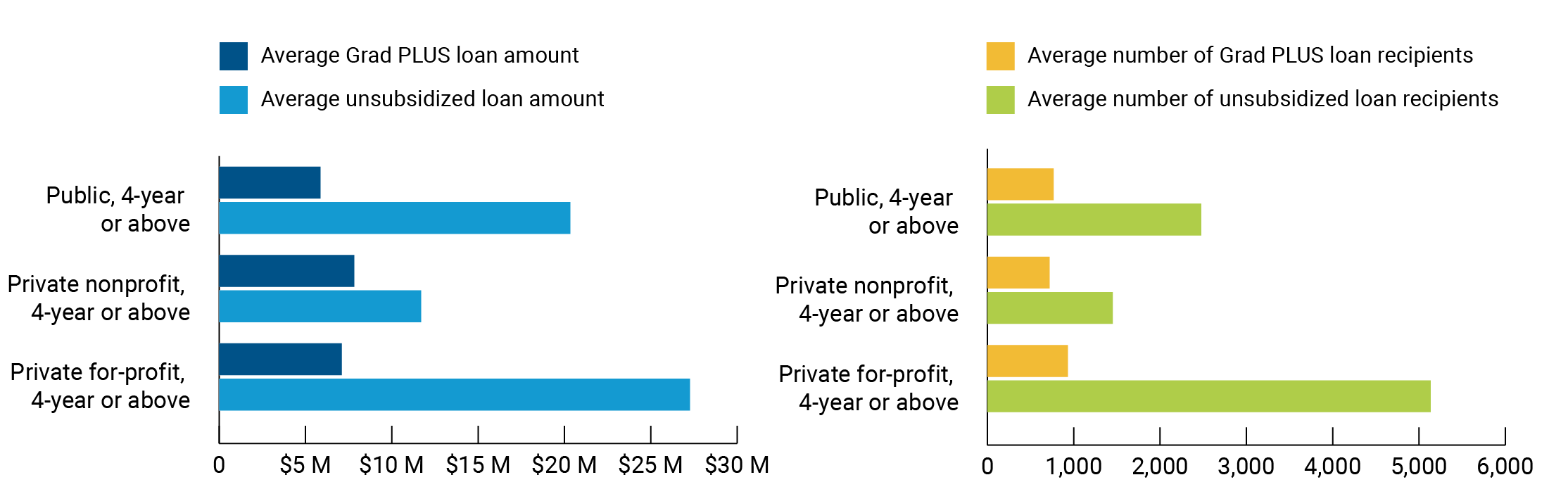

Unlike undergraduate borrowing, total amounts borrowed for graduate loans are higher than expected at public four-year institutions, especially in the unsubsidized loan program. While there are far fewer graduate borrowers than undergraduate borrowers on average, the total amount that institutions disburse to graduate students is far greater.

Figure 2: Graduate Loan Disbursements

Source: Calculations based on data from Federal Student Aid, “2019–2020 Award Year Direct Loan Volume by School, Quarter 4,” Title IV Program Volume Report (Washington, DC: U.S. Department of Education, 2022); College Scorecard Institutional Data, 2018–19 (Washington, DC: U.S. Department of Education, 2022).