Since March 13, 2020, most federal student loan payments have been paused and interest has been set to 0 percent. The U.S. Department of Education placed these loans in administrative forbearance, meaning that borrowers who are not making payments are not counted as in default. The number of borrowers in forbearance has increased from 4.6 million to 25.4 million—450 percent—since the beginning of the repayment pause. Currently 60 percent of all borrowers are in forbearance.

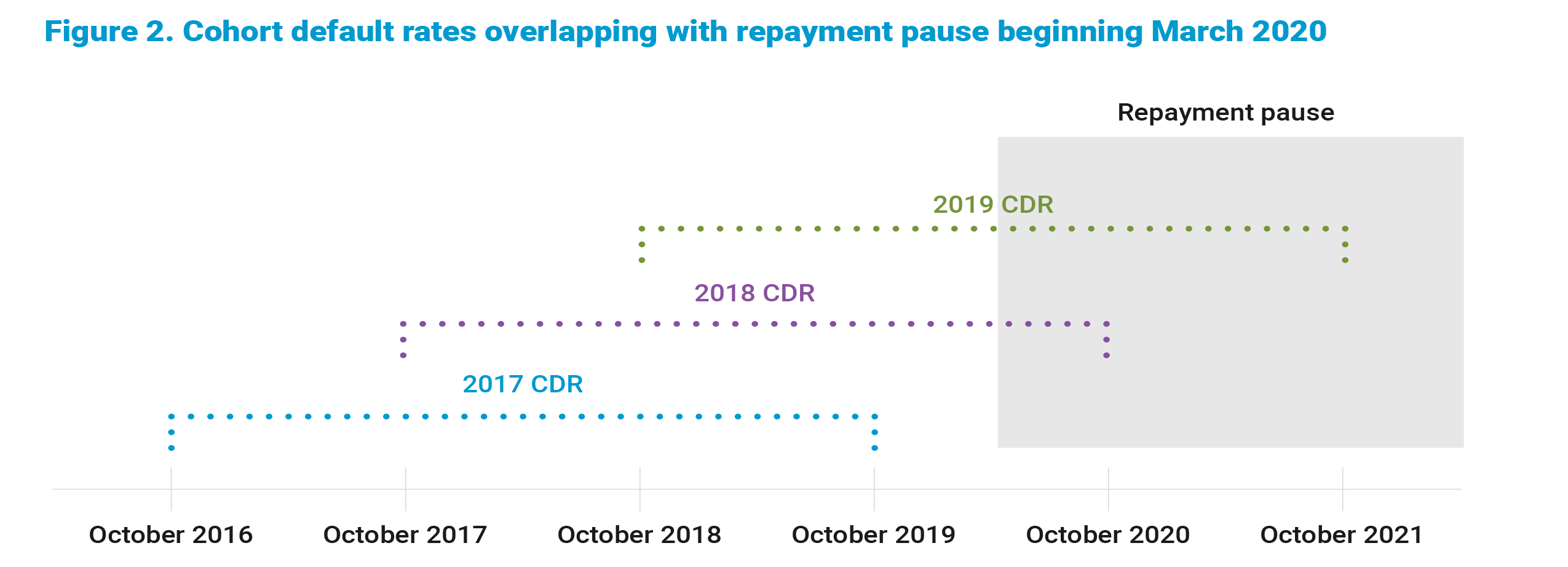

Because the CDR is measured across three years, it will take some time before the CDR reflects the repayment pause. The 2018 CDR included borrowers who entered repayment in 2018 and defaulted in 2018, 2019, or 2020. That’s why the 2018 CDR dipped: many borrowers were unable to default during the last part of this time period since no payments were required.

The 2019 CDR, which will be released this fall, will include borrowers who entered repayment in 2019 and defaulted in 2019, 2020, or 2021. The pandemic repayment pause covers half of the time period included in the 2019 CDR, as shown in Figure 2. In all likelihood, we will see another sharp drop in the CDR.